In the latest post of this series, we provided an overview on the story of renal denervation and an update on the latest developments in this technology. In brief, though results from the Symplicity HTN-3 trial were disappointing and led to a pause on progress in this field in 2014, more recent clinical trials demonstrating the benefit of this procedure—such as Medtronic’s Spyral OFF-Med and Spyral ON-MED and ReCor Medical’s RADIANCE-SOLO—have reinvigorated interest in renal denervation and provided the impetus behind ongoing pivotal IDE trials into the technology.

In this post, we shed some light on open questions lingering from the previous post:

- Is there potential for a class effect for renal denervation platforms?

- Will only specific patient groups benefit from this emerging treatment?

- What kind of opportunity will renal denervation present for medtech companies going forward?

To answer these questions, we must look into how the failed trials differ from the successful ones, how distinguishing factors are incorporated into the ongoing pivotal trials, and what this means for companies that are developing (or are planning to develop) renal denervation platforms.

What makes a successful trial? Patient criteria adherence

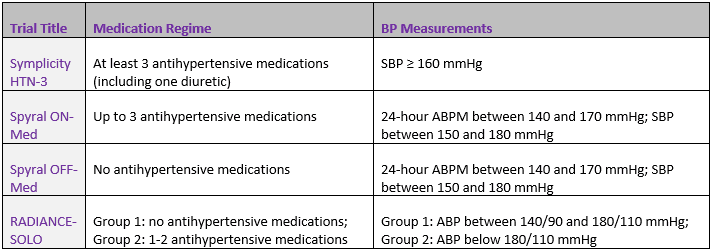

Perhaps the most evident factor differentiating successful trials from failed ones thus far is protocol adherence with regards to patient eligibility criteria. Some of the key inclusion criteria are outlined below:

Notably, given that the first of these trials failed while the others proved successful, one can postulate that the Symplicity HTN-3 failed not because the treatment was ineffective in the patients selected for that trial, but because it was not possible to verify that the changes in BP measurements were caused exclusively by the treatment; it may be the case that patients included in the control group did a better job than usual in adhering to their medication intake schedule, thereby distorting the impact of the therapy in the group that did receive treatment.

It was presumably this notion that led Medtronic and ReCor Medical to implement a strict and thorough protocol of adherence and observation in the trials that followed the Symplicity HTN-3; in Spyral ON-/OFF-Med and RADIANCE-SOLO, researchers witnessed medication intake, conducted multiple ABMP measurements, and included drug-naïve patients, among other measures, in order to isolate the effect of renal denervation therapy, which has thus far proven to be a more successful approach to trial design.

Going forward, product-specific clinical trials will be imperative

While the success of these trials has proven that the concept of renal denervation is effective in certain patients with certain devices, it does not attest to the efficacy of any similarly designed renal denervation platform; companies attempting or planning to develop renal denervation platforms will not only have to support the efficacy of renal denervation in hypertension patients, but will also have to demonstrate that their product in particular is effective and safe.

This idea becomes most apparent when one looks into Boston Scientific’s REDUCE HTN: REINFORCE trial, which utilized the company’s Vessix device and showed no benefit for hypertension patients, despite a trial design that is very similar to the successful studies mentioned above. More than anything, this trial reinforces the notion that not all devices are created equal, serving as a cautionary tale that may cause some companies to think twice before diving back into this space.

Going forward, the ongoing SPYRAL PIVOTAL and RADIANCE II trials appear to be building off the lessons learned from Symplicity HTN-3 and REDUCE HTN: REINFORCE. Some of the former’s key eligibility criteria include willingness to discontinue medications, SBP between 150 and 180 mmHg, and 24-hour ABPM averaging SBP between 140 and 170 mmHg; in the latter, the criteria include having previous or current antihypertensive therapy prescriptions and a daytime-ABP between 135/85 and 170/105 mmHg. In both studies, the outcome measures are far more extensive than in previous trials, showing a desire to continue isolating the effect of renal denervation.

DRG’s take: ultimate success of renal denervation is inevitable

Despite the numerous obstacles that have hindered the advance of this technology, it appears the march toward renal denervation as a trusted hypertension therapy is now well underway and will be difficult to deter going forward. For example, due to Medtronic’s most recent positive results, Abbott Laboratories may consider reviving the EnligHTN renal denervation platform (which it obtained through its acquisition of St. Jude Medical); to succeed, Abbott Laboratories (or any other similarly positioned companies) will have to build and design trials that can highlight specifically where and how its product in particular can be effective, which may require a series of trials just to figure out in which patients the company should test such a device.

From DRG’s knowledge and expertise in other markets where similar phenomenon have been observed, coupled with our extensive epidemiological solutions, our analysis leads us to believe that nearly 14 million patients may be eligible for renal denervation therapy once this technology is fully approved. Therefore, this market may offer companies substantial opportunities for growth worldwide. However, only competitors that gain a profound understanding of this technology, and those that are well prepared to conduct well-designed clinical trials that prove the efficacy and safety of their products in specific patient populations, will be able to capitalize on these opportunities.

DRG’s Market Insights team is currently in the process of preparing a report on hypertension therapies, which will highlight potential market opportunities in renal denervation in the future.

Looking forward, medtech companies should track the following questions as the market develops:

- What physicians will have the greatest impact on the referral pathway for renal denervation patients?

- How will physicians decide between competing renal denervation platforms?

- Will renal denervation be reimbursed, and how will reimbursement decisions affect pricing for these devices?

- Will the procedures be performed at centers of excellence for renal denervation, or will these be performed at existing facilities?

DRG will release a comprehensive analysis of the Global hypertension management device market, including market forecasts and competitive insights, in Q3 2019.