A Novartis subsidiary’s surprising exit last month from a closely-watched digital therapeutics partnership has prompted some soul-searching and prognosticating about the market potential of this emerging class of treatments. As my old MM&M colleague Marc Iskowitz put it in a typically thoughtful piece, “Since the Sandoz/Pear pact was widely seen as a litmus test of sorts for pharma’s role in helping distribute this nascent technology, the commercial break-up raises questions about the viability of such partnerships going forward,” and “highlights the parties’ sometimes conflicting priorities – pharma’s concern about its core business versus digital therapeutics firms’ worries about funding and investment.”

Marc concludes that the Sandoz/Pear breakup is an example of pharma’s earnings-centrism tamping down appetite for risk, the proximate cause having been a management change on the Sandoz side and a refocusing on driving revenue. The Pear solutions concerned, reSET and reSET-O, for substance abuse disorder and opioid disorder, respectively, are of particular interest in part because they’re thought to be the first true digital therapeutics (or DTx, an appellation indicating more stringent evidential and regulatory requirements than other digital health and medical solutions). For pharma, the trouble with these offerings, whether classified as DTx, digital medicines or digital health solutions, is that the gains won’t begin to supplant those from traditional therapeutics for many years, and pharma is an industry notoriously prone to letting quarterly earnings goals dictate corporate strategy.

New technologies, uncertain gains

Pharmas and medtechs aren’t the only parties weighing the cost of near-term investment against uncertain payoffs – payers are making similar calculations. As my colleague Shruti Desai, a market access expert at Decision Resources Group (DRG), put it: “There’s a churn that’s happening among many of the PBMs and insurers. If they invest today in an app for diabetes, the condition may manifest in 15 or 20 years and the patient may have moved on to another payer, so they can’t see whether this will realize value for their organization. Employer plans may be one area where we see more activity, as these plans see higher patient retention, and this gives them the opportunity to look at the long-term effects of digital therapeutics.”

We continue, nonetheless, to see pharmas and medtechs forging partnerships with tech companies on digital health solutions, and/or augmenting traditional therapeutics with digital tools and services. Recent weeks have seen Sanofi ink an agreement with Happify Health on a service designed to help MS patients cope with comorbidities, while BMS and Pfizer teamed up with Fitbit to develop an Afib detection algorithm to rival that of Apple Watch.

These partnerships can make a lot of sense for both parties, says DRG Director of Digital Strategy and Analytics Ben Katz. “Pharma has the channel and regulatory chops, and a team of reps,” says Ben, “while tech companies have the software infrastructure.” There are even a handful of pharmas and medtechs mounting serious DTx development efforts in-house, though for most, partnering with external developers is the point of entry.

Modest use, substantial demand for digital health tools

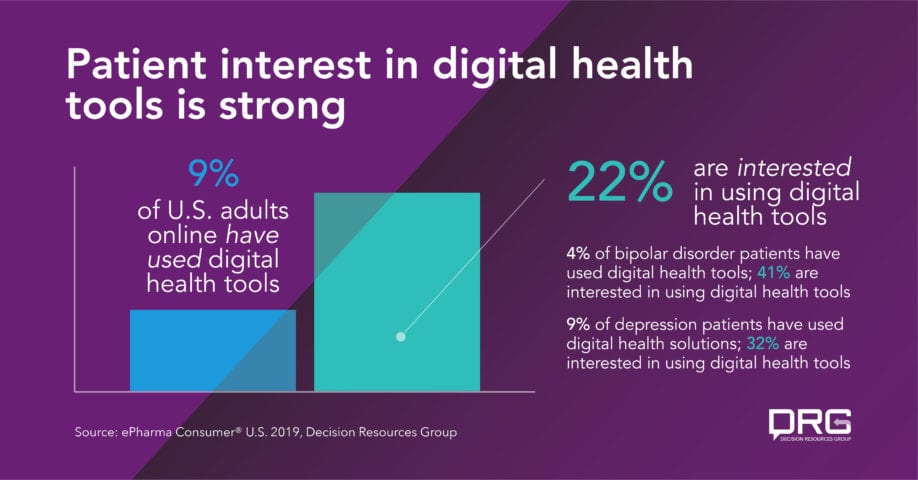

The demand is there for these solutions – while just 9% of U.S. adults online have used digital health tools, including DTx, 22% are interested in using these services, according to 2019 DRG patient study data.* And there’s particularly high unmet need among psychiatric disorders, where much of initial development has been concentrated – for example, while just 4% of bipolar disorder patients have used digital health solutions, 41% are interested in doing so. Nine percent of depression patients have used these tools – but 32% express interest in them.

Physician interest is also strong, at 44% in the U.S., although only 4% have prescribed a patient-focused medical app.** U.S. doctors are optimistic that DTx solutions will help educate and support their patients and excited about their utility in tracking treatment and generating data – though they worry about the paucity of quality offerings.

Regulators are readying themselves for DTx offerings, most notably in the U.S. – where FDA has established a pre-certification program for developers, along with a menu of fast-track clearance and approval processes – and the U.K., where NICE has undertaken high-profile partnerships with developers and laid out evidence standards guidelines for digital health solutions.

The biggest outstanding question about DTx remains: Who will pay for them? Developers are pursuing different models, including direct-to-consumer sales, enterprise plays pitched to governments, employers and insurers, and partnerships with pharmas, in which DTx solutions augment traditional therapies, potentially driving better patient health outcomes – and boosting the overall product profile in the eyes of payers. Recent moves by CVS and Express Scripts to help payers and employers evaluate digital health offerings suggest a path forward on this front.

Big data promises a bigger picture of patient health

It’s early days for these solutions yet, but so far, patients don’t see DTx rivalling traditional treatments and aren’t willing to pay out of pocket for them – just 10% say they would pay for a DTx as they would any other medication, and 12% say they would use a DTx in lieu of a traditional prescription medication.

Even as these questions shake out, some analysts see a bigger prize emerging.

“Now we’re finally beginning to see such penetration in really relevant populations, like elderly patients,” says DRG’s Lexie Code, Director of Medtech Learning. “Maybe the greater impact is not so much how the app helps better individual health but how the information that app collects connects with other data. Then you can begin to quantify what a baseline of health looks like, and you can really begin taking a preventative approach to some of these chronic conditions at scale.”

For now, pharmas and medtechs are learning, investing, experimenting and iterating around DTx, building inroads to the tech world and learning to set expectations. Apart from a few high-profile efforts – Otsuka’s Proteus tie-up on Abilfy MyCite for schizophrenia, the many smart inhalers for asthma and COPD treatments – their bets have been modest.

However, with clear regulatory guidelines in place and a pipeline packed with promising DTx solutions, nobody wants to be caught napping on these tools – even if models of development and reimbursement remain up in the air. It’s a safe bet that they will soon prove to be important differentiators for – and even competitors to – traditional therapeutics.

Are you launching a DTx or digital medicine-augmented healthcare product? You’ll need to understand the DTx/digital health landscape surrounding your offering or category. DRG can help with that. Click here to learn more about DTx landscape tracking and insights.

*ePharma Consumer® U.S. 2019, Decision Resources Group

**Taking the Pulse® U.S. 2019, Decision Resources Group