As large hospital systems have amassed greater power in their markets through mergers, developing regional integrated delivery networks and starting ACOs, health plans and providers have had to re-think the old oppositional relationship between payers and providers.

The last decade’s evolution of performance-based payments and value-based care, together with the technology and systems that make value-based care possible, have enabled new collaborative models that aim toward seamless integration of healthcare, information-sharing, and accountability. ACOs are a familiar and still-promising model, but many of these provider-based entities are not yet willing to take on substantial downside risk.

Insurers have used a variety of approaches to draw providers into sharing risk: Cigna has chosen to form medical home-style collaboratives, establishing more than 100 nationwide, of various sizes and configurations. UnitedHealth has teamed with ACOs in value-based contracts designed to increase risk over time. And through its Optum division, it has bought up numerous physician practices in key markets, and has purchased clinic and home health assets that it hopes to extend into those chosen markets. These assets are operated as multipayer providers but will use Optum’s systems and technologies.

The model that is perhaps most friendly to shared risk is that of the joint-venture health plan, a separate co-branded legal entity formed by an insurer and an IDN partner. As the technological tools of population health, EMRs, and operational readiness of regional IDNs have evolved and matured, we expect to see more joint-venture health plans established.

Joint ownership, clinical integration, and good branding

Major national insurers Aetna, Anthem, and Cigna have explored joint ventures since 2012, pairing with such renowned providers as Banner Health, Advocate Healthcare, and Cleveland Clinic. Among the most successful of these entities is Innovation Health, a partnership between Aetna and Inova Health System in northern Virginia. Begun in 2014, it has grown to serve 170,000 members and 1,200 plan sponsors. Another is Anthem’s JV plan Vivity Health, which includes seven Southern California hospital systems in an integrated commercial HMO designed to compete with giant Kaiser Permanente.

The partners typically form a separate entity to operate the joint venture health plan, creating its network chiefly from the hospital system, clinics, and its owned or affiliated physician groups. Compatible operating systems and data-sharing is established for sound population health management, with the health plan providing necessary claims handling functions. Within the plan, physicians can be expected to adhere to evidence-based protocols accepted by physician groups within the various specialties. Prior authorization and other pharmacy controls can be relaxed to some extent as the venture manages toward total cost of care for its patients.

For the hospital system, a JV plan projects the hospital’s brand while maintaining its autonomy, creates a separate legal entity that can shield the IDN from financial liability, and lets the plan take care of the administration and actuarial details. It creates a stream of patients for the hospital and its physicians, and potentially a new revenue stream. The JV also avoids the financial risks and operational pitfalls of hospital-run health plans.

The advantages to a health plan—particularly one looking to build its market share—are attractive as well. First off, it meets the goal of having providers take on downside risk, albeit for an initially small cohort of patients. The association with a trusted leading IDN creates goodwill for the carrier in the market and creates a branded narrow network of attractive providers. The structure also puts the hospital system and the carrier on an equal footing, with shared responsibility/reward for managing risk.

For commercial plan sponsors, such plans can offer a reasonably priced narrow network HMO as an insurance option for employees. Medicare Advantage plans in this model will likely succeed or fail on the strength of their physician networks, as seniors are far more loyal to their doctors than to any insurer.

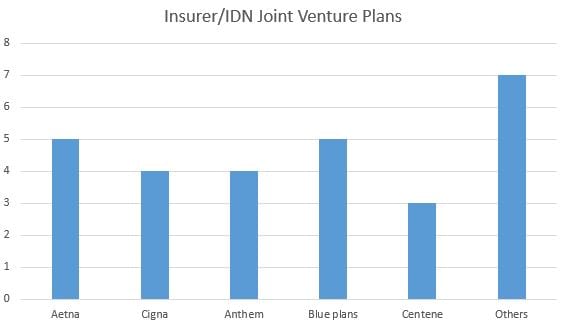

Of the 28 joint-venture plans now operating or announced, 21 operate commercial plans and nine offer Medicare Advantage plans. Aetna leads the industry in JV plans, with five established. Cigna and Anthem each have four, Centene has three.

These insurer/IDN plans are still a new phenomenon—12 of the 28 plans were established or announced in 2017—and their promise and staying-power are yet to be determined. Obviously, they work best in metropolitan regions where there is sufficient hospital competition, a cohort of willing physicians, and an IDN with the sophistication and scale to be an attractive plan partner. And the IDN must be sufficiently committed to the financial success of the JV plan to participate in keeping members in the lowest-cost appropriate care settings.

Ideally, these partnerships can provide the integrated “healthcare ecosystem” supported by a collaborative insurer partner, with better quality of care as the end result.